Adding a Credit Memo: Recording a Cash or Check Payment

If a parent has paid with cash or check, you can use the Add Credit Memo feature to record that invoice as paid for the player.

Adding a Credit Memo

To record a cash or check invoice, click on the Collections tab at the top of the screen. Scroll down to your Participants Roster, and click the name of the participant you'd like to add the memo to.

Click the blue Add Credit Memo button on the right-hand side of the screen. Note: You will only see the Add Credit Memo button if the player has upcoming or unpaid invoices, so if they don't have any, the button will not appear. If you have a cash or check payment to record to the player, you will need to add an invoice to their account first.

Select the group and season and enter the relevant details. While Notes are optional, keep in mind that the parent will see this on their account as well. So, if you are adding a check payment for example, you might want to add the check number for reference. Click Next.

Select the invoice you'd like to apply the credit to. If the payment was made for multiple invoices, you can apply that credit by splitting the amount. You must apply the whole credit amount before completing. When you're finished, click the blue Add Credit Memo button at the bottom.

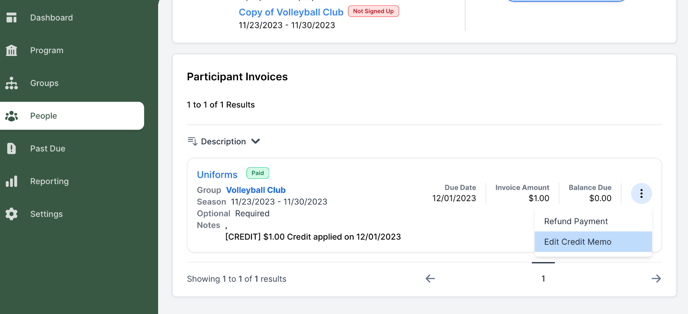

Once you add the credit, you will see the details in the description column. This is how it will appear for the parent as well.

Parent view: (credit memo of $5.00 applied here)

Note: Be sure that the credit memo is correct. If an applied credit only covers a partial amount of an invoice, and the parent pays the remaining amount with their bank or card through Snap! Spend, the credit memo can no longer be edited or deleted.

Editing a Credit Memo

If a credit memo had been added by mistake or you'd like to move that credit to another invoice, you can edit or delete it by clicking the 3 dots to the right of the invoice.

Still have questions or need help? Please reach out to us directly at spend.support@onsnap.com or by phone at 276-531-9260.

Snap! Spend is a financial technology company and is not a bank. Banking services provided by Thread Bank; Member FDIC. The Snap! Spend Visa Debit is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa cards are accepted.

Your deposits qualify for up to a maximum of $2,500,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity.

You can access the terms and conditions of the sweep program at https://thread.bank/sweep-disclosure/ and a list of program banks at https://thread.bank/program-banks/. Please contact customerservice@thread.bank with questions on the sweep program.