Canceling Check Payments

There are two ways to cancel a check payment that was created and sent out on Snap! Spend. See below for the two options:

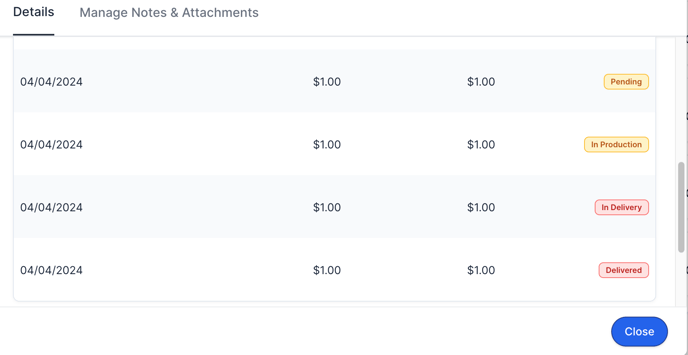

Both scenarios will require you to check the delivery status of the check. To do so, click on the transaction itself, scroll down in the pop-up box, and the complete transaction history will show.

Before a check has been mailed

Click on the transaction to see the current status of the check. If a check is in production, new or pending, it can be fully canceled.

From the right-hand side of the transaction, click the three dots and click "Request Cancel".

If successful, the check will no longer appear in the "Pending Checks" tab as it was successfully canceled.

After a check has been mailed out

If the check is shown as in delivery or delivered, the request cancel button will no longer work.

In this case, you will want to reach out to Customer Support at 276-531-9260 (ext 6) or spend.support@onsnap.com with the details of the transaction. A stop payment can be placed on the check. A stop payment will leave the check in pending, but it will be unable to be cashed. Though we are unable to halt a delivery after it has been mailed, if the user attempts to cash the check, it will be rejected.

A stop payment will be shown both on the Pending Checks tab and by clicking into the transaction:

Still have questions or need help? Please reach out to us directly at spend.support@onsnap.com or by phone at 276-531-9260.

Snap! Spend is a financial technology company and is not a bank. Banking services provided by Thread Bank; Member FDIC. The Snap! Spend Visa Debit is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa cards are accepted.

Your deposits qualify for up to a maximum of $2,500,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity.

You can access the terms and conditions of the sweep program at https://thread.bank/sweep-disclosure/ and a list of program banks at https://thread.bank/program-banks/. Please contact customerservice@thread.bank with questions on the sweep program.