Issue or Cancel a Refund

You can refund a payment by following these steps:

- Go to the participant page who you want to make the refund for

- Locate the payment you'd like to refund

- Click the 3 dots on the right-hand side of the screen

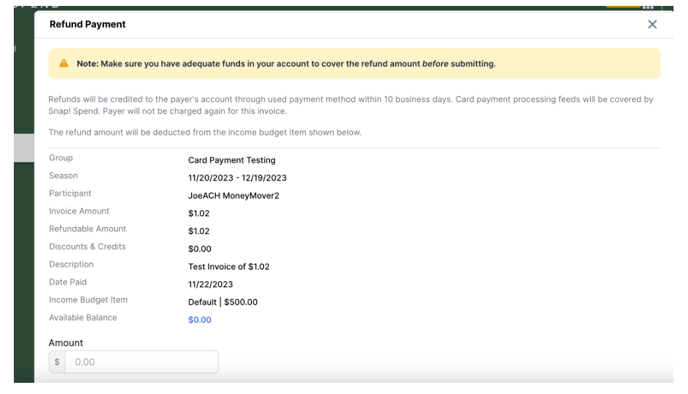

- Select Refund Payment, enter the amount you'd like to refund from that invoice payment, and then click Refund Payment to submit.

Only payments with a status of Paid can be refunded. If the status is Processing, you must wait for the payment to transition to Paid. (Click here for more information on Payment Processing Times)

When payments are refunded, the amount shown is withdrawn from the program or group account.

Refunds can take up to 10 business days to reach the parent and will be refunded to the same payment method they used to make the payment. If they paid with a card, Snap! Spend will refund the card processing fees.

Can I cancel a refund?

There is no way to cancel a refund. If a refund was processed by mistake, the best option would be to have the parent repay the amount refunded.

Still have questions or need help? Please reach out to us directly at spend.support@onsnap.com or by phone at 276-531-9260. (ext. 6)

Snap! Spend is a financial technology company and is not a bank. Banking services provided by Thread Bank; Member FDIC. The Snap! Spend Visa Debit is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa cards are accepted.

Your deposits qualify for up to a maximum of $2,500,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity.

You can access the terms and conditions of the sweep program at https://thread.bank/sweep-disclosure/ and a list of program banks at https://thread.bank/program-banks/. Please contact customerservice@thread.bank with questions on the sweep program.